What Does Transaction Advisory Services Mean?

Table of Contents3 Simple Techniques For Transaction Advisory ServicesOur Transaction Advisory Services DiariesEverything about Transaction Advisory ServicesNot known Facts About Transaction Advisory ServicesThe Single Strategy To Use For Transaction Advisory Services

This action makes sure the company looks its finest to possible customers. Getting the business's value right is crucial for a successful sale.Deal consultants step in to assist by getting all the required info organized, answering questions from customers, and arranging visits to the company's place. Deal consultants use their competence to assist company proprietors manage difficult negotiations, meet customer expectations, and framework offers that match the owner's objectives.

Satisfying lawful policies is important in any service sale. Transaction advising services collaborate with legal specialists to produce and review contracts, arrangements, and various other legal documents. This decreases threats and ensures the sale adheres to the legislation. The duty of transaction experts extends past the sale. They aid company owner in planning for their following actions, whether it's retirement, starting a brand-new venture, or managing their newly found wealth.

Transaction experts bring a wealth of experience and knowledge, ensuring that every element of the sale is handled expertly. With critical prep work, valuation, and negotiation, TAS assists organization proprietors achieve the highest possible price. By guaranteeing legal and regulative conformity and managing due persistance alongside various other offer employee, deal consultants lessen possible threats and responsibilities.

The Single Strategy To Use For Transaction Advisory Services

By comparison, Big 4 TS groups: Work with (e.g., when a prospective customer is carrying out due diligence, or when a bargain is closing and the customer needs to incorporate the company and re-value the vendor's Equilibrium Sheet). Are with charges that are not linked to the bargain closing effectively. Gain fees per involvement somewhere in the, which is much less than what financial investment banks make also on "tiny deals" (however the collection chance is also a lot greater).

The interview questions are really similar to financial investment banking interview inquiries, yet they'll focus much more on bookkeeping and valuation and less on topics like LBO modeling. As an example, anticipate inquiries regarding what the Modification in Working Capital means, EBIT vs. EBITDA vs. Web Earnings, and "accountant just" topics like test balances and just how to go through events using debits and credit scores as opposed to economic statement adjustments.

Some Ideas on Transaction Advisory Services You Need To Know

Experts in the TS/ FDD teams may also interview administration regarding everything above, and they'll create a detailed record with their findings at the end of the process.

The pecking order in Deal Services differs a little bit from the ones in investment banking and exclusive equity occupations, and the general shape resembles this: The entry-level function, where you do a great deal of information and monetary analysis (2 years for a promo from right here). The following degree up; similar job, but you obtain the even more intriguing little bits (3 years for a promo).

In particular, it's tough to get promoted beyond the Supervisor level due to the fact that few individuals leave the job at that stage, and you require to start showing proof of your ability to create revenue to breakthrough. Let's begin with the hours and lifestyle given that those are simpler to define:. There are occasional late evenings and weekend break work, yet look at this now nothing like the agitated nature of financial investment banking.

There are cost-of-living adjustments, so expect Visit Website reduced settlement if you're in a less costly place outside major financial (Transaction Advisory Services). For all positions other than Companion, the base pay makes up the bulk of the overall compensation; the year-end perk may be a max of 30% of your base income. Commonly, the very best method to increase your revenues is to switch over to a different firm and bargain for a greater salary and reward

Some Known Details About Transaction Advisory Services

At this phase, you need to just remain and make a run for a Partner-level duty. If you want to leave, perhaps relocate to a customer and execute their valuations and due diligence in-house.

The primary issue is that due to the fact that: You usually need to join another Huge 4 group, such as audit, and work there for a couple of years and after that relocate right into TS, job there for a couple of years and after that move into IB. And there's still no guarantee of winning this IB role since it depends upon your region, clients, and the employing market at the time.

Longer-term, there is likewise some danger of and since examining a business's historic monetary info is not precisely rocket science. Yes, humans will always require to be entailed, however with advanced innovation, lower head counts can possibly support client engagements. That claimed, the Purchase Solutions group beats audit in regards to pay, job, and departure chances.

If you liked this article, you might be interested in analysis.

The Ultimate Guide To Transaction Advisory Services

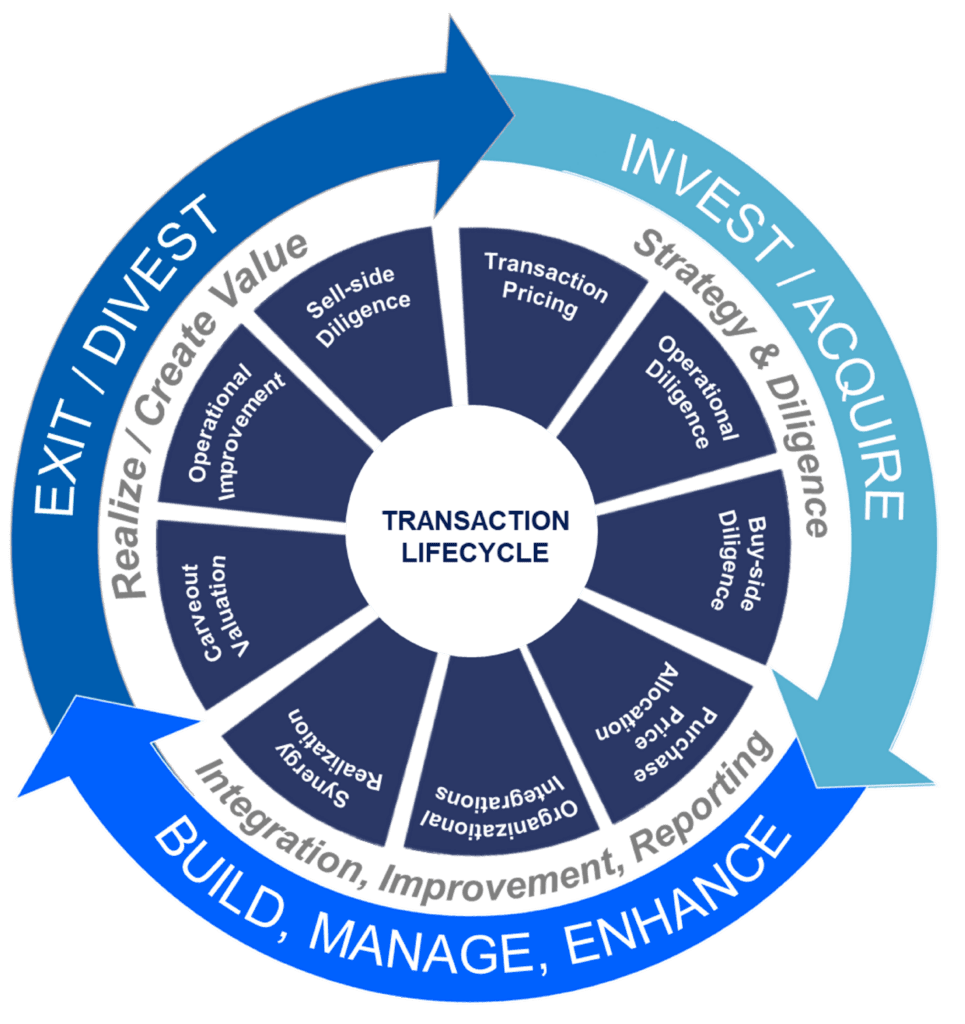

Establish innovative economic frameworks that assist in identifying the actual market price of a company. Give advisory work in relation to company assessment to aid in negotiating and rates frameworks. Clarify one of the most ideal kind of the bargain and the sort of factor to consider to use (cash money, supply, gain out, and others).

Create activity prepare for danger and exposure that have been identified. Perform integration planning to determine the procedure, system, and business adjustments that might be needed after the offer. Make numerical estimates of assimilation prices and advantages to analyze the financial reasoning of combination. Set guidelines for incorporating departments, innovations, and company processes.

Examine the possible customer base, webpage sector verticals, and sales cycle. The functional due persistance offers crucial understandings into the performance of the company to be obtained worrying danger analysis and worth production.